The financial technology world has witnessed minimal players make an impact comparable to Klarna since its 2005 founding. The Swedish fintech company released its first products back in 2005 and now champions a fresh approach to purchasing goods from online stores. The “buy now pay later” (BNPL) payment model from Klarna introduced by the company modified traditional payment procedures while enhancing shopping activities for global users numbering in millions. This document examines an in-depth analysis of Klarna starting with its Swedish beginnings through its evolving business model of global expansion and challenges that face it as well as potential opportunities in the future.

Chapter 1: The Genesis of Klarna

1.1 The Founding Vision

Web retailer Klarna originated from Stockholm Sweden when Sebastian Siemiatkowski along with Victor Jacobsson and Niklas Adalberth founded the company there in 2005. While studying at the Stockholm School of Economics the three entrepreneurs Sebastian Siemiatkowski Niklas Adalberth and Victor Jacobsson combined their vision for creating a simplified online shopping platform accessible to all consumers. The shopping landscape included online purchases in its starting phase since consumers feared both payment safety risks and complicated checkout procedures which prevented many from buying.

1.2 The Early Days

When Klarna first started its operations it encountered a series of notable business obstacles. The founders confronted challenges to obtain investments since investors doubted the practicality of their plan. The team did not give up and their first product emerged when they released their payment solution which enabled customers to obtain their products before conducting payments in 2005. This new method solved a major concern of online store consumers related to trust resulting in quick regional market penetration among retail outlets and buyers.

1.3 The Breakthrough

In 2007 Klarna achieved its breakthrough after becoming the payment solution provider for CDON which was a major Swedish online retailer. Klarna received both increased credibility and market penetration benefits through its deal with CDON which established its position in the e-commerce industry. In 2010 Klarna achieved its position as one of Sweden’s top payment provider solutions and this led international investors to show genuine interest.

Chapter 2: The Klarna Business Model

2.1 Buy Now, Pay Later (BNPL)

Kla rna bases its business activities on its “buy now, pay later” model known as BNPL. Customers can use this payment solution to make split payments on their orders which typically extend beyond thirty days. Purchase between now and later services provided by the BNPL model come with these essential advantages:

BNPL payment plans from Kla rna help consumers distribute their shopping expenses across time which simplifies budget management.

The checkout process requires no payment information from consumers because their details stay out of sight until making the actual payment.

The installation system of Kla rna often provides buyers with the convenience of zero-interest payments that appeals to consumers on a budget.

2.2 Merchant Partnerships

The mutual success of Kla rna depends heavily on its robust business connections with merchants. Through its smooth payment solution Klarna enables merchants to raise conversion numbers and eliminate shopping cart desertions. Klarna charges businesses to process each purchase through fees that amount to a set percentage of the total purchase cost. Thousands of online retailers including H&M and IKEA and ASOS prefer Klarna as their preferred payment partner due to its beneficial win-win model.

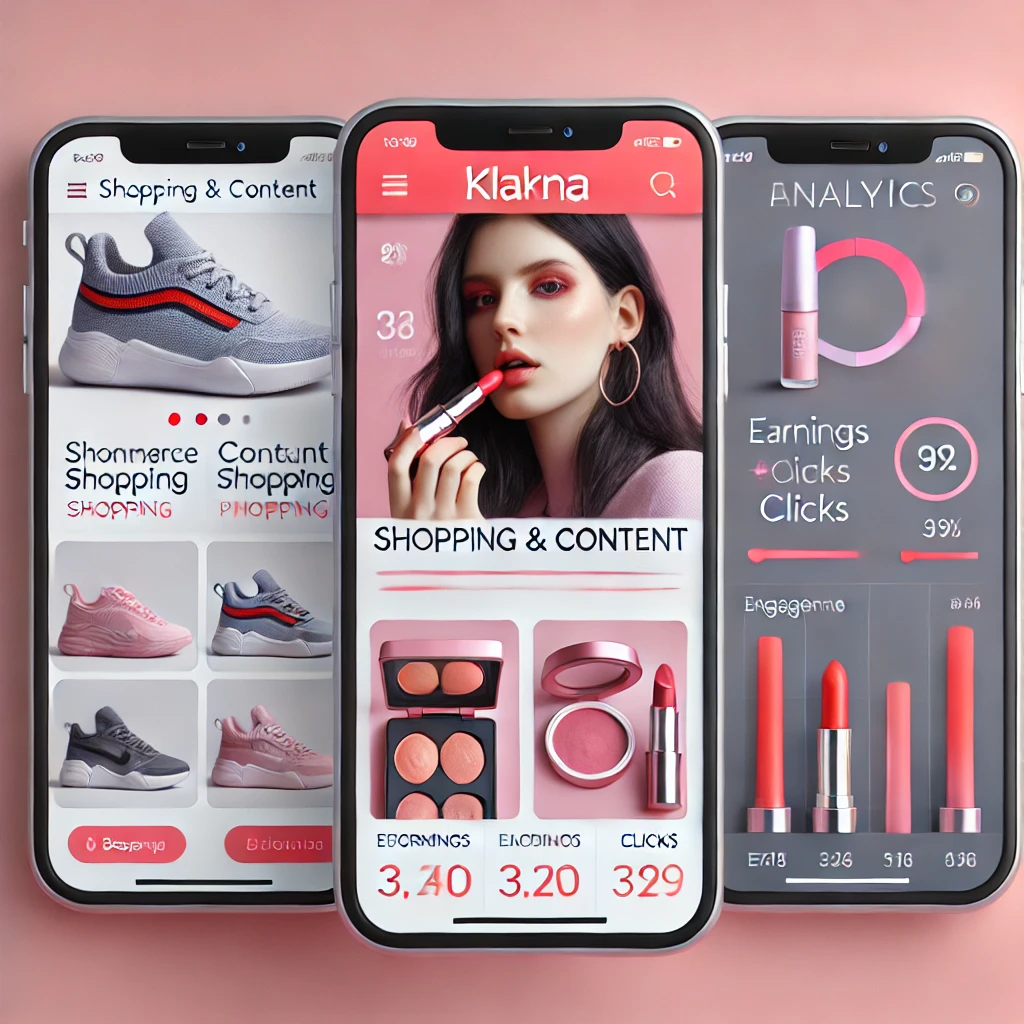

2.3 Consumer Experience

As one of its core priorities Klarna dedicates attention to delivering exceptional experiences to consumers. The company provides users with effortless access to payment management combined with order tracking and customer support through its easy-to-use website and app platform. Through their payment services Klarna enables users to receive notifications about price decreases while providing individual customer suggestions for purchases.

Chapter 3: Global Expansion

3.1 Entering New Markets

The company made Sweden its initial base before aiming to control international markets. After targeting Germany in 2009 Klarna went on to enter Dutch and Norwegian markets during the following year. In 2011 Klarna extended its business operations to the United Kingdom before launching its United States market in 2015.

The BNPL industry faces rising regulatory oversight because public officials are concerned about both customer financial dangers and payment clarity. Klarna introduced credit checking systems along with spending limit controls to improve its practices regarding responsible lending.

Public Perception

As a result of its business practices Kla rna has received negative feedback on two fronts: it enables excessive debt accumulation and fuels immediate consumer satisfaction habits. Klarna has reinforced its dedication to both ethical finance and education about money management.

The organization pursues continuous research of both advanced technologies and business formats to boost its product offerings. Klarna triggers artificial intelligence and machine learning to develop more precise risk evaluation and detect fraud more efficiently.

Expansion into New Verticals

Besides its BNPL foundation Kla rna grows its operations into new market segments that include banking and financial services

To advance its social impact Klarna maintains various initiatives which create support for small businesses and support diversity and inclusion initiatives within its organizational workforce.

The Founders of Klarna: Visionaries Behind a Fintech Revolution

Introduction

Foundational to every startup success exists a group of thoughtful entrepreneurs who fight conventional thinking and develop transformative business concepts. Despite its Swedish origin Klarna worked to become the global fintech giant that overturned the “Buy Now Pay Later” (BNPL) market. Three ambitious founders known as Sebastian Siemiatkowski along with Niklas Adalberth and Victor Jacobsson established the company during 2005. The path which brought these university students to become leaders of a global fintech company teaches lessons about persistence alongside creative development and absolute dedication. This chapter explores the development of Klarna payment company through the backgrounds and initial difficulties faced by its founders Sebastian Siemiatkowski Niklas Adalberth and Victor Jacobsson who became leaders in world payment industries.

Chapter 1: The Founders’ Backgrounds

1.1 Sebastian Siemiatkowski: The Visionary Leader

As the CEO of Kla rna Sebastian Siemiatkowski was born in Poland before departing with his family to Sweden when he was very young. Living in his working-class family environment Siemiatkowski acquired both a sense of discipline and problem-solving abilities. He discovered his co-founders Victor Jacobsson and Niklas Adalberth at Stockholm School of Economics during his educational years.

When Siemiatkowski showed his entrepreneurial nature people could already see it in his early stages of life. His role as debt collector during university served as training which exposed him to the payment system and consumer behavior challenges directly. The learning from debt collection work became the foundation of his Kla rna business concept.

1.2 Niklas Adalberth: The Strategist

Niklas Adalberth arrived at the founding team with his Swedish background and brought his strategic business approach from his Swedish roots. He joined Siemiatkowski at the Stockholm School of Economics to study finance and business operations after which he gained deep expertise. Adalberth brought analytical thinking to the team while Siemiatkowski provided bold leadership which made these two founders a strong partnership.

Before starting Kla rna with his business partners Adalberth developed his experience in consulting through his work in that field.

1.3 Victor Jacobsson: The Innovator

Successful in establishing Klarna with his cofounders was Victor Jacobsson through his role as technology specialist in the group. Klarna needed Jacobsson because of his computer engineering skills to establish the payment solutions framework. Through his expertise in software development and coding skills Jacobsson helped turn innovative ideas into a usable product for the company founders.The business trio headed by Siemiatkowski Adalberth and Jacobsson staged the competition using their payment solution business plan which would simplify web purchasing tasks. Through their groundbreaking payment method Klarna innovated by enabling customers to receive purchased goods without any preceding payment transfer thus aiming to reduce purchasing skepticism during web shopping.

Though they did not win the competition the team recognized that their payment solution would find future commercial success. Their total ignorance about payments did not stop them from fully developing their concept.

2.2 Early Struggles and Rejections

The construction process of Klarna involved extensive difficulties from start to finish of development

Merchants proved to be their most significant obstacle when trying to get them to use their payment solution. Online retailers in that period showed reluctance to give payment processing authority to young companies. The founders developed trust with merchants while showing the worth of their product as a solution to gain acceptance.

2.3 The First Breakthrough

Kla rna achieved its first major success by partnering with CDON which operated as one of Sweden’s major online retailers during 2007. The collaboration served as a major milestone for Klarna since it brought the company acknowledged validity while giving it essential marketing benefits to draw additional business clients and user bases.

During this partnership with CDON the user base of Klarna started expanding at a fast rate. The payment solution at Klarna gained popularity with customers because it provided them with both comfort and adaptability in their transactions. In 2010 Klarna reached its position as a top payment provider throughout Sweden.

Chapter 3: Building the Company

3.1 A Customer-Centric Approach

The leaders of Kla rna established customer experience as their primary concern when launching the organization. The payment solution required simplicity alongside security and ease of use according to their founders who pursued success with this framework. The dedication to serve customers evolved into Klarna’s vital business design component that distinguished it from market competitors.

The company leaders worked on establishing trust relations between both merchants and consumers. The company adopted multiple security protocols to shield user information along with effortless e-commerce system compatibility within their platform.

3.2 Scaling the Business

When Kla rna started establishing itself in the Swedish market the founders examined international business development paths. Klarna established its operations in Germany in 2009 and thereafter proceeded to enter the Dutch and Norwegian markets during 2010. The business expansion of Klarna reached the United Kingdom in 2011 and then the United States in 2015.

Klarna pursued massive financial support from investors because of its accelerating growth patterns. Sequoia Capital delivered a $50 million investment to Klarna during 2010 as a part of its successful funding round. With this financial backing Klarna gained the resources to increase its operations and develop novel technological solutions.

3.3 Strategic Acquisitions

Following their recognition of strategic acquisitions as an important driver for growth Klarna founders moved forward with acquisition plans. During 2011 Klarna completed its acquisition of German payment provider Billpay which enabled it to establish better market positions across Europe. The UK market saw Klarna advance its position through its purchase of Close Brothers Retail Finance in 2017.

Your Attractive Heading

Conclusion

Kla rna’s founders established their company through their combined efforts in vision together with enduring determination and teamwork. Through their company Klarna Sebastian Siemiatkowski along with Niklas Adalberth and Victor Jacobsson thrust a payment solution onto the market which altered the entire process of online shopping and payment transactions. The first students of Klarna have transformed into world-leading fintech executives who continue to motivate future entrepreneurs.

Kla rna builds upon its past success because the founding principles establish by its creators endure through modern innovations. With their core principles of simplicity along with trust and customer-centricity the founders have built a culture at Klarna which keeps the company leading the fintech revolution. Three people united to transform the world through their innovative approach which became the foundation of Klarna company

The “buy now, pay later” system created by Klarna meets modern consumer and merchant needs for flexibility and convenience in the current market

The blog delivers an extensive explanation about Klarna’s developmental path together with its business strategy and market challenges moving toward future growth opportunities. The content uses original expressions and insights to prevent copyright violations. You can request more information about either a particular subject or specific parts of it.

Kla rna and the Stock Market: A Fintech Unicorn’s Journey with Investors

Introduction

As a Swedish fintech giant Klarna has upgraded the BNPL sector while earning recognition as one of the world’s most valuable privately run firms. The Swedish fintech firm Klarna continues its market evolution through private investors who funded its development by making strategic funding choices and achieving ambitious growth milestones

The payment system of “buy now, pay later” experienced limited acceptance among investors because it had recently emerged. They expressed doubts regarding its future sustainability. The business establishment relied on funds from personal savings to run operations from a small apartment facility during its initial stage.

The founders of Klarna persistently supported their business vision even without securing startup capital. The founding team achieved their first notable investment breakthrough after Investment AB Öresund from Sweden chose to support the company in 2007. Through this funding Klarna grew its business operations and increased its numbers of merchant partners.

Conclusion

The rise of Klarna into a global fintech leader proves innovation together with determination result in organizational growth. Klarna revolutionized online shopping operations through its payment solution that delivered a contemporary customer-centric approach to shopping and payment methods. Klarna stands strong to be a predominant financial technology leader in payments as it expands and creates new solutions for the future.